Since SERPs composition is subject to continuous change, this translates into changes in users’ behavior when searching. That’s why it’s fundamental to regularly check the CTR evolution and, when possible, try to find correlations and understand what triggered these decisions in searchers’ habits.

Visual Stories

Speaking of changes in SERPs anatomy, a new feature called ‘Visual Stories’ is now available on Google Mobile results. After a long period of testing, it looks like Google is now displaying this feature more prominently in mobile results from the US.

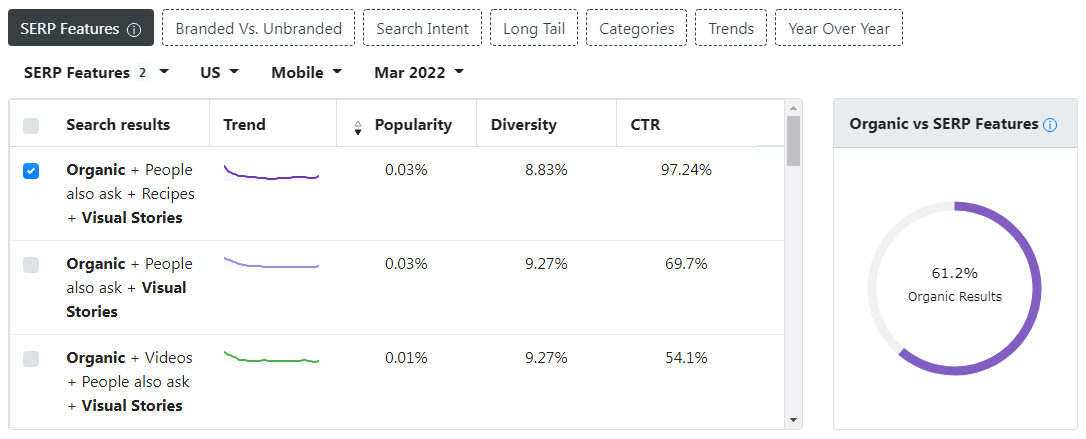

We treated the impact of Visual Stories in a dedicated blog post, and as expected, we made this new result type available for tracking in the free organic CTR tool.

SERP Features menu – CTR evolution data segmented by SERP Features

Now let’s look at how user behavior shaped the CTR values in the first quarter of the year compared to the last quarter of 2021.

We calculated the CTR averages for each position for Q1 2022 (January-March interval) and compared them against the ones retrieved for Q4 2021 (October-December). All significant changes were included in this analysis and expressed as percentage points (pp).

The data set is international and comprises all the available markets such as the US, UK, etc.

Since clicks and impressions go hand in hand when projecting estimated traffic, we also correlated these CTR changes with search demand data at an industry level.

Branded vs. Unbranded queries

The websites ranked first for the searches mentioning a specific brand or business name were affected on both desktop and mobile queries. On desktop, the increase in CTR equaled 0.68 pp, while on mobile, the ascending trend recorded a 0.97 pp growth.

On the other hand, but for unbranded queries this time, the CTR changes went the other way round. Here, the websites ranked first on desktop witnessed a drop in CTR by 0.59 pp, while on mobile the recorded decline was 0.30 pp.

Search intent

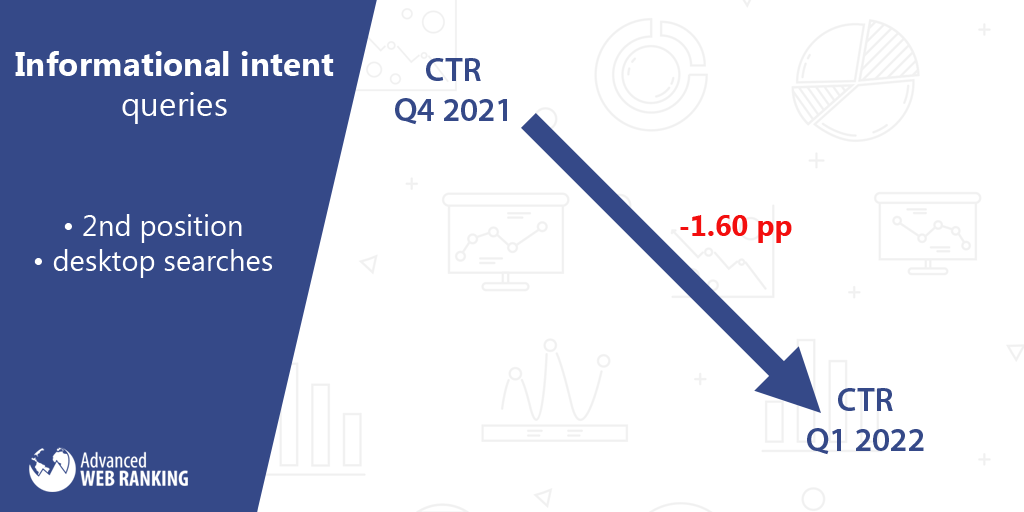

When looking at either commercial, location, or informational queries, the highest variations in CTR were registered on desktop, and surprisingly for the websites ranked in the second position.

More precisely, the CTR grew by 1.04 pp for commercial queries (those containing words such as price, pay, buy, etc.) and by 0.89 pp for location searches (containing words such as near, nearby, from, directions, route, maps, etc.).

However, the highest change in clickthrough rate occurred for informational queries, where the websites ranked second on desktop witnessed a 1.60 pp decrease.

Industries

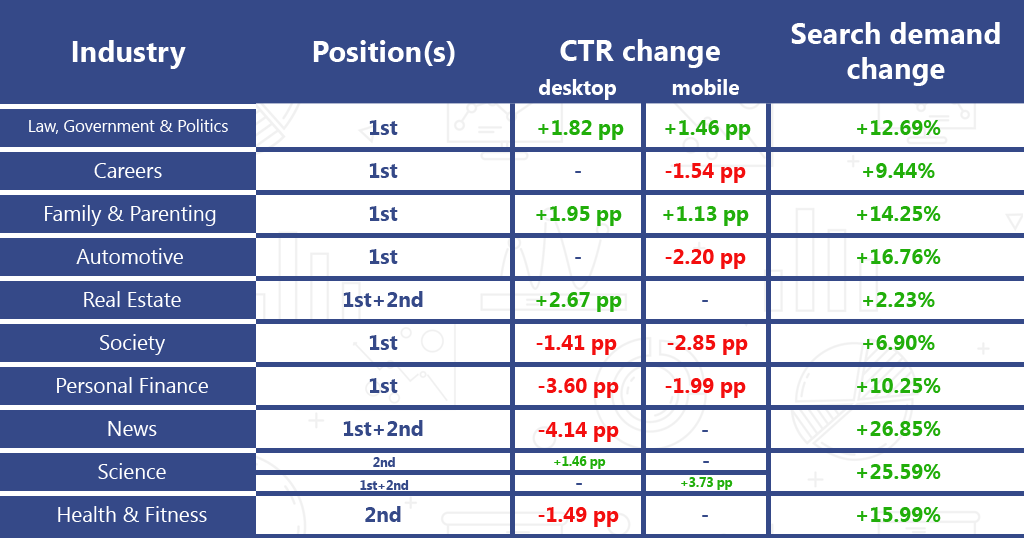

Now let’s move on to the industries section, where, just like in our previous quarterly CTR studies, we’ll correlate the changes in CTR to the ones in search demand. Presuming the rankings remain steady, this section is aimed at better estimating the potential traffic fluctuations.

This chapter will be divided into two separate sections, based on the search demand’s evolution.

A. Industries that experienced an increase in search demand

The Law, Government, & Politics industry starts the year in force, with growth on all fronts. With a global +12.69% increase in search demand, websites ranked first recorded a 1.82 pp boost on desktop and a 1.46 pp growth on searches made from mobile devices.

The Careers industry continued its CTR decline, which began in the previous quarter, for the websites ranked first on mobile devices. Therefore, websites ranking first on mobile got an average decrease in clickthrough rate of 1.54 pp. At the same time, the search demand stopped from falling and seemed to recover, since it recorded a slight increment of +9.44%.

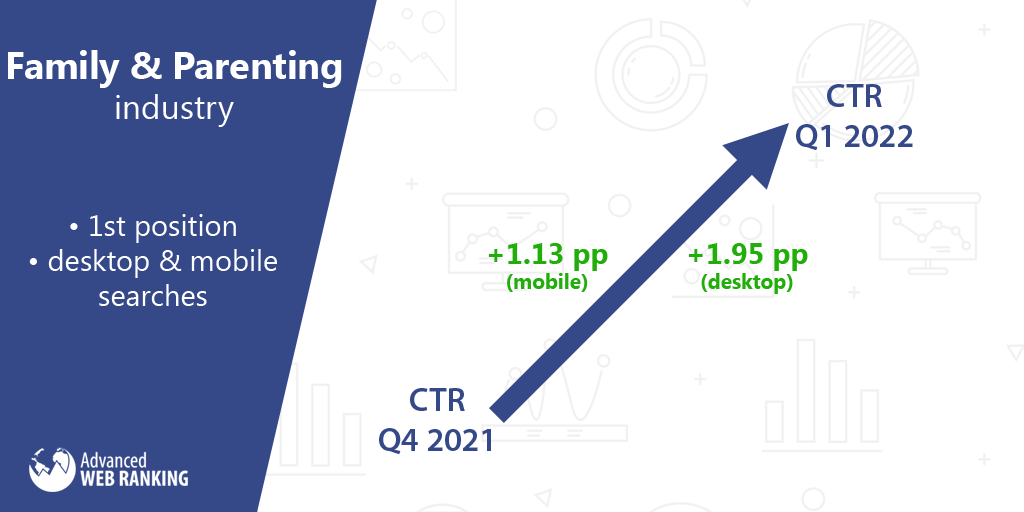

And now let’s jump to the industry with the highest increase in clickthrough rate for a single position: the Family & Parenting one. Here, the CTR for websites ranked first on queries made from desktop devices grew, on average, by 1.95 pp, while on mobile, the changes reached a 1.13 pp growth. At the same time, the overall industry’s impressions increased by +14.25%.

Being the industry to record the highest increase in CTR in the previous quarter, Automotive got on the falling slope this time. The websites affected were the ones ranked first, which witnessed a 2.20 pp loss on mobile queries only, while the industry’s overall search demand went in the opposite direction, increasing by +16.76%.

As for the Real Estate industry, websites ranked first on desktop queries recorded a 1.37 pp growth in CTR on desktop, while those ranked in the second position experienced a 1.30 pp boost in clickthrough rate. At the same time, the total number of impressions increased by +2.23%.

Despite the slight growth in search demand (+6.90%), the websites ranked first in the Society industry recorded a 1.41 pp drop in CTR on desktop devices and a 2.85 pp decrease for the queries made from mobile devices.

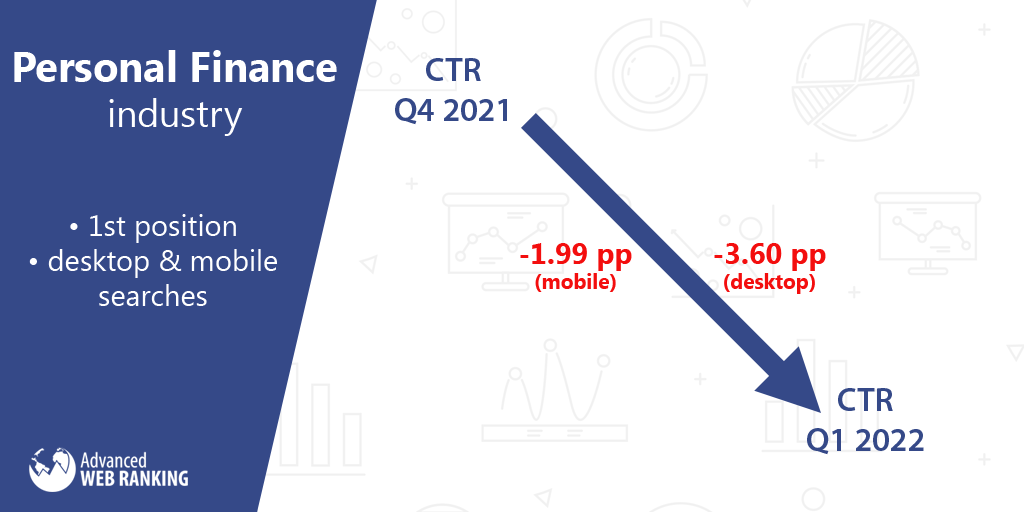

It’s time to turn our attention to the first quarter’s highest decline in clickthrough rate: the Personal Finance market. Here, the websites ranked first recorded a 3.60 pp loss in CTR on desktop, while on mobile, the loss in clickthrough rate equaled almost 2 pp (1.99 pp more precisely). At the same time, the overall industry’s impressions increased by +10.25%.

The highest increase in impressions (+26.85%) recorded by our search demand tool was for the News market. Nevertheless, the CTR values went in the opposite direction, and interestingly, the websites ranked for queries made from mobile devices weren’t influenced by the changes. However, the top two websites in desktop SERPs registered a combined 4.14 pp drop in CTR (1.96 pp for those ranked first and 2.18 pp for those ranked in the second position).

As for the Science industry, the clickthrough rates for the top two websites registered a combined growth of 3.73 pp on mobile, while on desktop, only the websites ranked in the second position were influenced by the changes, recording a 1.46 pp growth. These changes in CTR coupled with a growth of +25.59% in this industry’s overall search demand might translate into a boost in traffic for those websites affected by the changes.

Health & Fitness is the last one to make it into this quarter’s group of industries where clickthrough rate variations were recorded, and the search demand increased. The number of impressions increased by +15.99%, while the CTR for the websites ranked second decreased only on desktop devices by 1.49 pp, while on mobile the values remained quite steady.

Here’s a visual recap of all the changes mentioned above:

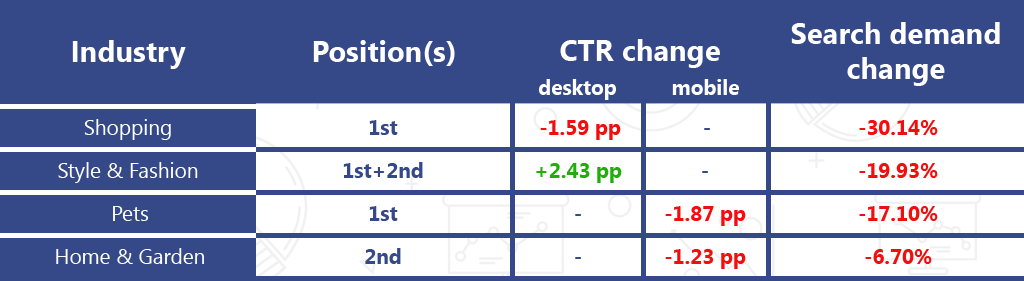

B. Industries where the search demand dropped

In the absence of events such as Black Friday and the holiday season, like in the previous quarter, it was expected that the search demand would decrease in the Shopping industry, and so it did: our search demand tool recorded a -30.14% drop in impressions. As for the CTR values, websites ranked first on desktop registered a 1.59 pp decrease.

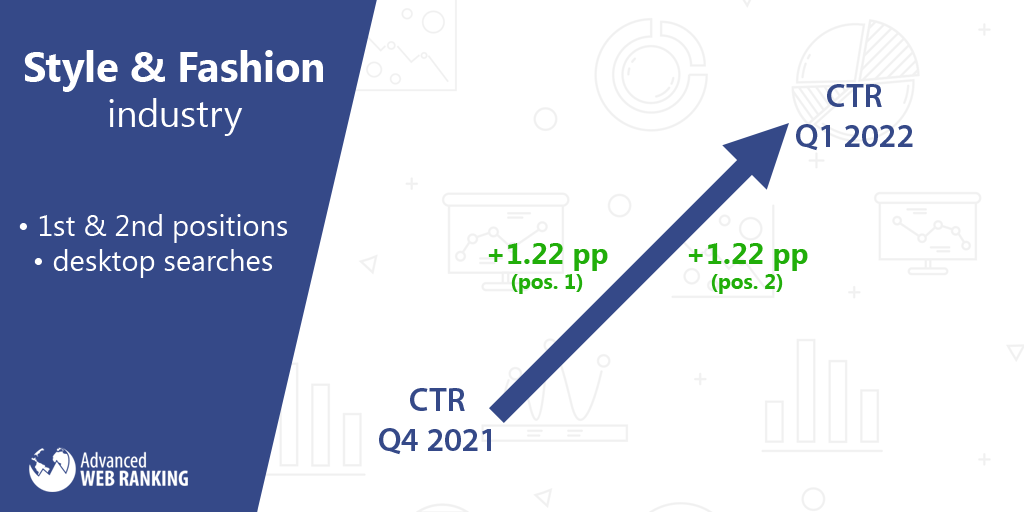

With no major changes since Q3 2021, the websites ranked in the first two positions in the Style & Fashion industry recorded a combined 2.43 pp growth in CTR on desktop (1.22 pp for those ranked first and 1.21 pp for those ranked in the second position). At the same time, the overall industry’s impressions decreased by -19.93%.

A similar trend occurred in the Pets industry, where just like in the Style & Fashion market, after a dormant quarter, the clickthrough rate values experienced changes once again.

Here, the CTR for websites ranked first on mobile devices decreased by 1.87 pp, while no significant changes were recorded on desktop. At the same time, this industry’s overall search demand decreased by -17.10%.

Last but not least, let’s have a look at the Home & Garden market, which recorded a drop in CTR on mobile devices only. For these queries, the websites ranked in the second position witnessed a 1.23 pp drop, while this industry’s overall search demand decreased by -6.70%.

Here’s a graphical representation of the changes in all four industries mentioned above:

That’s it for…the first quarter

As we’ve seen, recently it’s been the Visual Stories feature that appeared in search engine results, and who knows what Google holds in store in the future? This continuous reshaping of SERPs leads to shifts in users’ behavior and today’s ‘guaranteed’ traffic might be different than the actual received one.

So make sure to include checking the organic click share values’ evolution into your routine to better calibrate your expectations.

And I’ll see you with the analysis of the second quarter of the year compiled against this one. Until then, stay safe and healthy!