Make every Life Full.

This is the core value of Lifull Co., Japan’s largest real estate database. With tens of millions of users each month, the portal is strongly focused on high volume, quality and ease of housing and property searching.

Shin Okubo works with the SEO Strategy Division, mentoring a team of 20+ specialists.

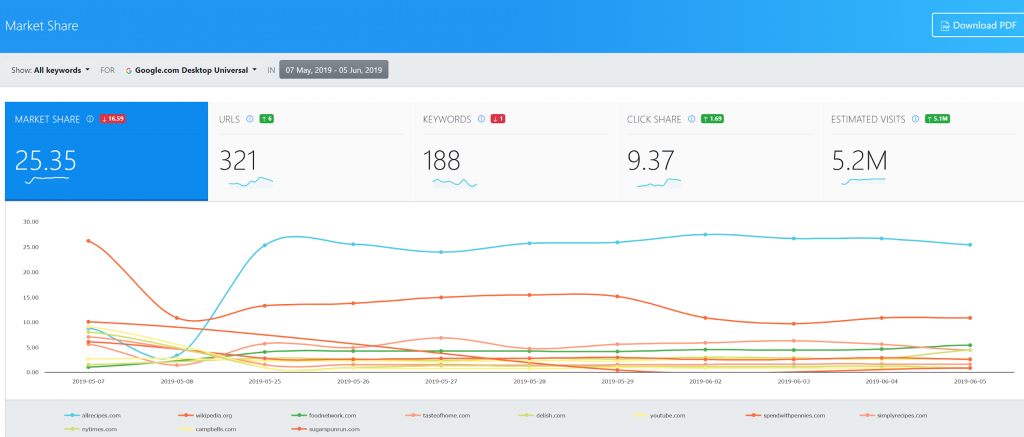

We have been evaluating Advanced Web Ranking for some time, and started using the platform in 2019. Implementing Market Share was a key decision factor 😉 Our business values this figure, and the ability to show it in dashboards is very good for us.

Shin Okubo, SEO Strategy Division Lifull Co.

Currently, the team at Lifull works with multiple AWR accounts, monitoring location based ranking positions on a daily basis. The keywords are segmented in more than 100 groups, and performance is compared against 5 top competitors.

The Challenge

Running an SEO competitor analysis with AWR was already possible for static competitor sets, with the help of two visibility metrics: Click Share and Estimated Visits. When combined, these metrics provide an estimation of the traffic share driven by keywords ranking in Top 20.

Yet, getting a clear image is a bit more tricky when operating in a highly competitive industry, where the digital search landscape is so dynamic. There was still a question that Shin and the team could not resolve directly with AWR for their analysis:

How much are the Estimated Visits representing from the max possible traffic value?

During the discussions with Shin, we understood that finding the answer was very time consuming for the team. They had to export top sites and visibility data from AWR after every ranking update, and further run formulas in Excel in order to understand the competitor distribution and compute the actual share on the search market.

The Solution

With this pain point in mind, we thought of a way to automate the process, and came up with a new Visibility report in AWR:

Market Share looks at the Estimated visits that a domain or a URL gets from organic search, and it computes the percentage that it represents from the max possible value. In doing so, it takes into account all competitors from the SERPs, not just those which are actively monitored in the AWR project settings.

Once the implementation process was completed, we tested the new metric and competitor discovery algo together with Shin, and here’s what we found:

New competitors across the global keyword set

Shin and the team were tracking 5 competitor domains, all based in Japan. With the new development, we found a new competitor that was gaining a market share wider than two of those already monitored. In addition, this competitor’s market share trend showed a constant growth during the last month’s updates.

The team decided to add the new competitor to the AWR project in order to keep a closer eye on it in the future, find their best performing landing pages and further analyze the SERPs for it’s top keywords.

If you’re new to AWR, sign up for a free 30 day trial to check out the visibility reports live, with your own ranking data.

New and emerging competitors had a different distribution at keyword group level

Following the analysis on the competitor landscape across the entire set of keywords, we thought we should check what happens for specific keyword segments.

For this purpose, we looked at the 190 groups defined by Shin and made a selection for analysis by two criteria:

Performance

Here, we looked at search discoverability, so we selected the keyword groups that had the highest visibility percent, largest number of top 10 positions and largest number of impressions according to Google Search Console.

Then we looked at the incoming traffic, and selected the groups that had the largest number of clicks and highest CTR.

Search Intent

For this analysis, we looked at the keyword semantics and made the split by informational and commercial intent.

We ended up with a selection of 7 groups that we showed Shin during one of the discussions. The analysis that we presented included two types of data:

Aggregated

We showed the market share split on each group of interest, for both the existing and the new competitors discovered. On each group, the market share distribution was different among the known competitors. In addition, we pointed out two more competitor domains that were holding an important part of the total estimated traffic for those terms.

Granular

For each competitor, we could point directly to the exact landing pages that drove the highest market share, and to the specific keywords that helped them gain that share.

Some final thoughts

Based on the insights gained from the Market share analysis by keyword group, Shin and the team were able not just to measure the performance and find new competitors, but also to identify specific keywords that they could further target on the SEO flow.

What about you? It’d be interesting to learn how you discover new competitors and run comparative analyses!

Feel free to share your thoughts in the comments section.

6 comments

Thanks Aura for this wonderful article. Easy and simple answers. Keep up the good work.

Thank you Jane! Happy you like it 🙂

Stunning work, thank you so much for taking the time to share!

Lovely post, really enjoyed reading this. Thank you for sharing.

Thanks Aura for the useful information.

Great insight on this case study Aura. Researching your competitors and finding keywords with search intent are extremely crucial to succeed online. Great to see AWR helping with that.

Comments are closed.